RISKS: By understanding the risk, proper Risk management can be done

1 Risk in investing can well be explained in following ways.

Doing business is riskier than secured job .Entrepreneur is taking more risk.

There is risk to reward ratio to be decided by risk taking appetite into consideration.

One chooses, well established brand for franchise business, because of good track record, so the chances of good returns are there and failure are less.

One can choose a fund based on the basis of its track record of AMC [Asset Management Co.] and Scheme if old one .Past performance doesn't assure you of guaranteed returns. It is only the factor to be considered.

2 SAFETY: Mutual fund is the trust and investor is beneficiary.

3 Regulated by SEBI

IMPORTANT for fund selection: Fund selection should not be only based on sole criterion of returns given in past. This should only be one factor not the sole basis. One should consider risk adjusted returns.

Analogy: If driver takes you to a destination faster may not be necessarily good. He might have taken extra risk. You may not mind little more time but it could be safer. Slightly fewer returns with lower risk could be better.

LIQUIDITY: Redemption is done and payment is done in 3 days generally in open ended schemes.

Why Invest in mutual funds and not in Equities directly?

ANS:

Professional Management.

Diversification with small amount.

Advanced research.

Myths

1). New NFO@Rs 10/unit is cheaper.

2). Less NAV fund is cheaper than more NAV fund.

3). MF with entry load is Expensive and likely to give less returns than without entry load.

Types of MF

A). Equity Funds

B). Debt Funds

C). Hybrid Funds

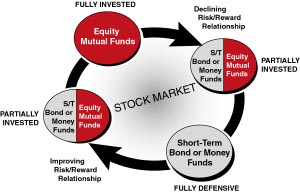

Depending upon the risk profile and the Investment objective one has to choose the appropriate Fund.

ELSS: An alternative to conventional savings, this has lock in period of 3 yrs only.

STRATEGY: SIP [Systematic investment plan] and STP [Systematic Transfer Plan] is recommended to tide over any possible volatility in equity markets. Historically this has Worked excellent in most turbulent times.

Note: Go to links for seeing returns, in mutual fund schemes of various companies

www.valueresearchonline.com

www.moneycontrol.com

UTI

|

MERRILL LYNCH |

SBI MUTUAL FUND |

|

|

|

TATA MUTUAL FUND |

STANDARD CHARTERED MUTUAL FUND |

LIC MUTUAL FUND |

|

|

|

PRUDENTIAL ICICI MUTUAL FUND |

HSBC MUTUAL FUND |

ABN AMRO |

|

|

|

HDFC MUTUAL FUND |

FRANKLIN TEMPLETON INVESTMENTS |

KOTAK MUTUAL FUND |

|

|